Is the Gulf Stream slowing down?

|

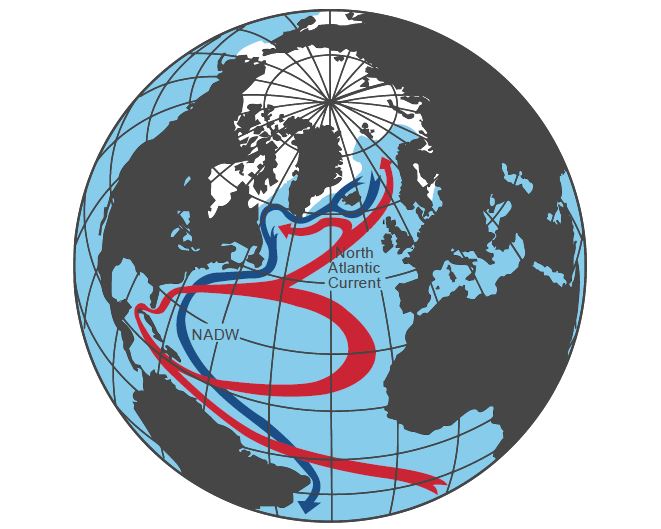

| Source: Rahmstorf, Nature 1997 |

Changes in Atlantic Ocean circulation worries scientists

The risk of abrupt and/or irreversible climate change is determined by a crossing of tipping elements in the Earth system. One such tipping element is the North-South ocean current circulation in the Atlantic Ocean, also known as the Gulf Stream system. The Gulf Stream system is one of Earth’s most important heat transport systems, pumping warm water northwards and cold water southwards. It is responsible for the mild climate in northwestern Europe and the most important source of heat transport to Scandinavia.

A potential abrupt change, or slowing down of the Gulf Stream circulation could lead to a weakening of heat transportation towards the Arctic which in turn would result in a cooling effect of high northern latitudes (including Scandinavia).

Scientists at Potsdam University have now found evidence for a slowdown of the Gulf Stream (published in Nature). Multiple lines of observation suggest that in recent decades the current system has been weaker than ever before in the last 1000 years. The gradual but accelerating melting of the Greenland ice-sheet, caused by man-made global warming, is a possible major contributor to the slowdown.

“Now freshwater coming off the melting Greenland ice sheet is likely disturbing the circulation”, says Jason Box of the Geological Survey of Denmark and Greenland. The melting glaciers are diluting the North Atlantic ocean salty water. Less salty water is less dense and doesn’t sink to the ocean deep as easy.

The observed cooling in the North Atlantic, just south of Greenland, is stronger than what most climate models have predicted so far. One reason for this is that most computer simulations underestimate the stability of the Gulf Stream or don’t account properly for the Greenland ice sheet melt. This is yet another example where observations suggest that climate models are too conservative when it comes to the pace at which certain aspects of climate change are proceeding.

A slowing down of the Gulf Stream will not lead to a new ice age but it could have major negative effects on ocean ecosystems and thereby fisheries and coastal livelihoods. A slowdown also adds to the regional sea-level rise affecting cities like New York and Boston. Further weakening of the current could also result in temperature changes in the northern latitudes, influencing weather systems on both sides of the Atlantic, in North America as well as Europe.

.png)

0 kommentarer: