From growth to inequality and collapse

Economic growth as people know it, in terms of GDP, has stagnated and started to turn negative. Most reactions to the absence of growth have consisted in trying to get it back again as fast as possible, whatever the cost, further degrading the biosphere at an accelerated rate. We have seen low interest rates, debt expansion, bank bailouts, government stimulus, land-grabs, tax havens, fiscal austerity, and stock buybacks etc. Most of these things did nothing to increase the wellbeing of ordinary people but greatly profited the richest in society. The massive debt overhang from such policies have now become a burden on the real economy. All it did was to divert people's attention from the inconvenient truth that there will be less material goods and energy flows in the future, not more.

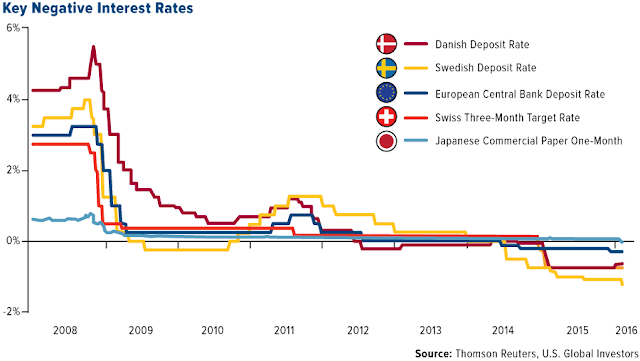

This massive wastefulness of resources comes at a time when we could have used those means to invest in benefitting projects like affordable housing, a basic income, low carbon infrastructure, ecologically sound agriculture, adaptation to climate change etc. Instead we have chosen to let the oceans contain more plastic than fish and species go extinct a thousand times faster than any time in the last 65 million years. The central bank and governments desperate policies after the 2008 financial crisis is the biggest failure in our time. When the next crisis hits, which could be very soon, there will be neither fiscal nor monetary room for manoeuvre.

In his latest paper Tim Jackson show how declining growth in the real economy caused by resource limitations has led to increasing economic inequality. A factor that greatly increases the instability of a society. The rising inequality that has haunted advanced economies over the last decade is a direct consequence of policy decisions trying to promote growth in a dying capitalistic society that cannot be supported by underlying fundamentals. All it has done is to redistribute wealth from the bottom to the top. The growth fetish has hindered ecological investments, reinforced inequality and exacerbated financial instability. The social and ecological prosperity that once was is being undone by this allegiance to growth at all costs.

As shown in the HANDY-model (2014), overexploitation of both nature and labour leads to a fast total collapse of society. Economic stratification is a symptom often found in many past collapsed societies and is an outcome of elite overconsumption in a society overshooting its ecological carrying capacity. Such a collapse often lead to inequality-induced famine, due to widespread poverty, that causes the loss of workers rather than a collapse of the ecological base itself. Elites consumption keeps growing until the society collapses.

This is a very ugly possibility. And it shows just how important issues of ecological degradation and inequality are for social stability. The fact that we see widespread resource/economic inequality indicate that we, some societies more than other but talking globally, are far gone in the process towards collapse.

However, in another paper by Jackson, there are post-growth scenarios that dont necessarily lead to increasing inequality. Jackson claims that it depends on three structural features of the economy: elasticity of substitution between labour and capital, the dynamics of the capital-to output ratio, and the behaviour of the savings rate. Under conditions more favourable to wage labour (than capital) measures like a tax on capital and a universal basic income can decrease inequality even as growth decline. However, these measures are insufficient to reduce inequality when institutions aggressively favour capital over labour.

.png)